Do You Pay Vat On Bank Fees . adding vat to bank fees would increase costs for consumers. In general, bank charges are exempt from one’s vat. As previously explained, bank charges not exempt from vat cannot be reclaimed. but should one declare their bank transfer charges on their vat return or or pay vat on them? You are exempted from including them while filling in your vat. in the uk, you do not need to pay tax on bank charges. It is important for banks and customers to understand the vat. bank charges can have vat implications, depending on the type of service or transaction involved. the straight answer to this question is no, you don’t need to pay vat on bank charges. This means that your bank’s charge transactions are exempt from vat.

from blog.payoneer.com

In general, bank charges are exempt from one’s vat. It is important for banks and customers to understand the vat. You are exempted from including them while filling in your vat. This means that your bank’s charge transactions are exempt from vat. As previously explained, bank charges not exempt from vat cannot be reclaimed. but should one declare their bank transfer charges on their vat return or or pay vat on them? bank charges can have vat implications, depending on the type of service or transaction involved. in the uk, you do not need to pay tax on bank charges. adding vat to bank fees would increase costs for consumers. the straight answer to this question is no, you don’t need to pay vat on bank charges.

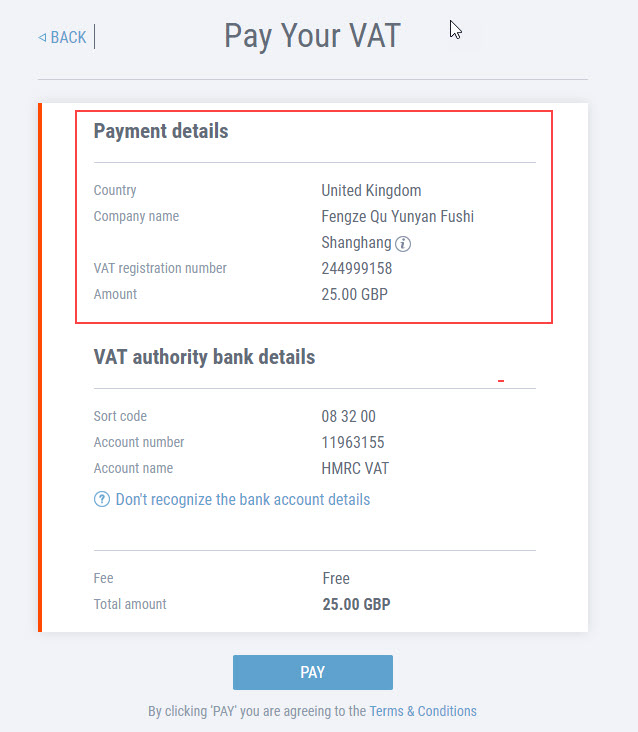

How to pay VAT from your Payoneer balance with no transfer fees! Payoneer Blog

Do You Pay Vat On Bank Fees in the uk, you do not need to pay tax on bank charges. This means that your bank’s charge transactions are exempt from vat. As previously explained, bank charges not exempt from vat cannot be reclaimed. In general, bank charges are exempt from one’s vat. adding vat to bank fees would increase costs for consumers. but should one declare their bank transfer charges on their vat return or or pay vat on them? the straight answer to this question is no, you don’t need to pay vat on bank charges. in the uk, you do not need to pay tax on bank charges. It is important for banks and customers to understand the vat. You are exempted from including them while filling in your vat. bank charges can have vat implications, depending on the type of service or transaction involved.

From digitalcornerstone.co.uk

Do You Pay VAT On Shopify Fees? Digital Cornerstone Do You Pay Vat On Bank Fees in the uk, you do not need to pay tax on bank charges. In general, bank charges are exempt from one’s vat. It is important for banks and customers to understand the vat. This means that your bank’s charge transactions are exempt from vat. but should one declare their bank transfer charges on their vat return or or. Do You Pay Vat On Bank Fees.

From wattsfordfinance.co.uk

Pay your VAT Bill with a VAT Loan Wattsford Finance Do You Pay Vat On Bank Fees In general, bank charges are exempt from one’s vat. but should one declare their bank transfer charges on their vat return or or pay vat on them? It is important for banks and customers to understand the vat. the straight answer to this question is no, you don’t need to pay vat on bank charges. This means that. Do You Pay Vat On Bank Fees.

From www.zoho.com

VAT Payments Help Zoho Books Do You Pay Vat On Bank Fees bank charges can have vat implications, depending on the type of service or transaction involved. adding vat to bank fees would increase costs for consumers. This means that your bank’s charge transactions are exempt from vat. in the uk, you do not need to pay tax on bank charges. the straight answer to this question is. Do You Pay Vat On Bank Fees.

From www.sage.com

How to write an invoice and what to include Sage Advice United Kingdom Do You Pay Vat On Bank Fees It is important for banks and customers to understand the vat. As previously explained, bank charges not exempt from vat cannot be reclaimed. the straight answer to this question is no, you don’t need to pay vat on bank charges. in the uk, you do not need to pay tax on bank charges. adding vat to bank. Do You Pay Vat On Bank Fees.

From yourecommerceaccountant.co.uk

Do UK eBay Sellers Have To Pay VAT On Fees? Blog Do You Pay Vat On Bank Fees adding vat to bank fees would increase costs for consumers. bank charges can have vat implications, depending on the type of service or transaction involved. the straight answer to this question is no, you don’t need to pay vat on bank charges. but should one declare their bank transfer charges on their vat return or or. Do You Pay Vat On Bank Fees.

From linkmybooks.com

Do You Pay VAT on eBay Fees Link My Books Do You Pay Vat On Bank Fees It is important for banks and customers to understand the vat. adding vat to bank fees would increase costs for consumers. the straight answer to this question is no, you don’t need to pay vat on bank charges. but should one declare their bank transfer charges on their vat return or or pay vat on them? As. Do You Pay Vat On Bank Fees.

From cruseburke.co.uk

VAT on the eBay Fee Calculator UK CruseBurke Do You Pay Vat On Bank Fees adding vat to bank fees would increase costs for consumers. the straight answer to this question is no, you don’t need to pay vat on bank charges. This means that your bank’s charge transactions are exempt from vat. You are exempted from including them while filling in your vat. bank charges can have vat implications, depending on. Do You Pay Vat On Bank Fees.

From www.tide.co

What is VAT, how much is it and how much to charge? Tide Business Do You Pay Vat On Bank Fees It is important for banks and customers to understand the vat. This means that your bank’s charge transactions are exempt from vat. in the uk, you do not need to pay tax on bank charges. but should one declare their bank transfer charges on their vat return or or pay vat on them? the straight answer to. Do You Pay Vat On Bank Fees.

From www.slideserve.com

PPT Do eBay Sellers have to Pay VAT on Fees PowerPoint Presentation, free download ID11735022 Do You Pay Vat On Bank Fees It is important for banks and customers to understand the vat. the straight answer to this question is no, you don’t need to pay vat on bank charges. In general, bank charges are exempt from one’s vat. This means that your bank’s charge transactions are exempt from vat. As previously explained, bank charges not exempt from vat cannot be. Do You Pay Vat On Bank Fees.

From chartmaster.bceweb.org

Vat Chart Of Accounts A Visual Reference of Charts Chart Master Do You Pay Vat On Bank Fees As previously explained, bank charges not exempt from vat cannot be reclaimed. You are exempted from including them while filling in your vat. adding vat to bank fees would increase costs for consumers. This means that your bank’s charge transactions are exempt from vat. It is important for banks and customers to understand the vat. in the uk,. Do You Pay Vat On Bank Fees.

From info.techwallp.xyz

Hmrc Vat Bank Details Management And Leadership Do You Pay Vat On Bank Fees As previously explained, bank charges not exempt from vat cannot be reclaimed. bank charges can have vat implications, depending on the type of service or transaction involved. adding vat to bank fees would increase costs for consumers. In general, bank charges are exempt from one’s vat. but should one declare their bank transfer charges on their vat. Do You Pay Vat On Bank Fees.

From www.studocu.com

Notes Input VAT INPUT VAT Creditable Input VAT not ALL input VAT paid on purchases is Do You Pay Vat On Bank Fees bank charges can have vat implications, depending on the type of service or transaction involved. This means that your bank’s charge transactions are exempt from vat. adding vat to bank fees would increase costs for consumers. but should one declare their bank transfer charges on their vat return or or pay vat on them? It is important. Do You Pay Vat On Bank Fees.

From www.business2arts.ie

What are the bank fee sources paid by a user annually? Do You Pay Vat On Bank Fees You are exempted from including them while filling in your vat. in the uk, you do not need to pay tax on bank charges. This means that your bank’s charge transactions are exempt from vat. As previously explained, bank charges not exempt from vat cannot be reclaimed. but should one declare their bank transfer charges on their vat. Do You Pay Vat On Bank Fees.

From kiteview.co.za

Invoice Cheat Sheet What You Need To Include On Your InvoicesKiteview Do You Pay Vat On Bank Fees It is important for banks and customers to understand the vat. in the uk, you do not need to pay tax on bank charges. As previously explained, bank charges not exempt from vat cannot be reclaimed. In general, bank charges are exempt from one’s vat. adding vat to bank fees would increase costs for consumers. You are exempted. Do You Pay Vat On Bank Fees.

From unicornaccounting.co.uk

Do you pay VAT on eBay fees? Unicorn Accounting Do You Pay Vat On Bank Fees the straight answer to this question is no, you don’t need to pay vat on bank charges. bank charges can have vat implications, depending on the type of service or transaction involved. In general, bank charges are exempt from one’s vat. You are exempted from including them while filling in your vat. in the uk, you do. Do You Pay Vat On Bank Fees.

From blog.payoneer.com

How to pay VAT from your Payoneer balance with no transfer fees! Payoneer Blog Do You Pay Vat On Bank Fees but should one declare their bank transfer charges on their vat return or or pay vat on them? You are exempted from including them while filling in your vat. in the uk, you do not need to pay tax on bank charges. It is important for banks and customers to understand the vat. This means that your bank’s. Do You Pay Vat On Bank Fees.

From www.svtuition.org

Journal Entries of VAT Accounting Education Do You Pay Vat On Bank Fees As previously explained, bank charges not exempt from vat cannot be reclaimed. This means that your bank’s charge transactions are exempt from vat. in the uk, you do not need to pay tax on bank charges. but should one declare their bank transfer charges on their vat return or or pay vat on them? the straight answer. Do You Pay Vat On Bank Fees.

From unicornaccounting.co.uk

Do you pay VAT on Shopify fees? Unicorn Accounting Do You Pay Vat On Bank Fees This means that your bank’s charge transactions are exempt from vat. It is important for banks and customers to understand the vat. bank charges can have vat implications, depending on the type of service or transaction involved. the straight answer to this question is no, you don’t need to pay vat on bank charges. In general, bank charges. Do You Pay Vat On Bank Fees.